The terrorist attacks on September 11, 2001, left nearly 3,000 people dead at the World Trade Center in New York City; the Pentagon outside Washington, D.C.; and in the field in Shanksville, Pennsylvania where Flight 93 crashed after passengers and crew bravely attempted to regain control of the plane. Thousands more suffered and continue to suffer from injuries and illnesses directly related to the attacks and the rescue, recovery, and clean-up efforts.

In the aftermath of the 9/11 attacks, the September 11th Victim Compensation Fund (VCF) was established to provide financial assistance to those who were injured in the attacks and the response to the attacks, as well as to the families or personal representatives of those who died.

While the attacks are now decades in the past, those who were present at any of the attack sites on that day or in the months that followed continue to be diagnosed with, and suffer and die from, illnesses directly related to the events of September 11, 2001.

Individuals injured on 9/11 or who have been diagnosed with a 9/11-related illness, or who have a loved one who has been diagnosed or died from a 9/11-related illness, may have questions regarding the September 11th Victim Compensation Fund and any award to which they may be entitled or which they may have already received. Specifically, they may be wondering who is entitled to compensation and if September 11th Victim Compensation Fund awards are considered taxable income by the United States Internal Revenue Service (IRS). The answers below may address these concerns.

What are September 11th Victim Compensation Fund awards?

The September 11th Victim Compensation Fund is a restitution fund for the families or personal representatives of those who died in the attacks and as a result of 9/11-related injuries and illnesses, and for those who continue to fall ill and suffer the devastating effects of injuries and illnesses related to the attacks and the rescue, recovery, and clean-up efforts.

September 11th Victim Compensation Fund awards are financial awards intended to cover medical expenses and loss of wages related to the events of September 11, 2001.

What is the Zadroga Act and how is it related to the September 11th Victim Compensation Fund?

The original September 11th Victim Compensation Fund was closed by Congress in 2004. However, the James Zadroga 9/11 Health and Compensation Act of 2010 (Zadroga Act) reopened the September 11th Victim Compensation Fund in 2011. The reactivated September 11th Victim Compensation Fund was authorized to operate from October 2011 until October 2016 and included expanded eligibility criteria, new filing deadlines, and limited funding.

In 2015, the Zadroga Act was reauthorized. The reauthorization extended the claim filing deadline to December 18, 2020, and increased the September 11th Victim Compensation Fund funding to $7.375 billion.

In July 2019, the “Never Forget the Heroes, James Zadroga, Ray Pfeifer, and Luis Alvarez Permanent Authorization of the September 11th Victim Compensation Fund Act” was signed into law. The law provides full funding to the September 11th Victim Compensation Fund to pay all eligible claims and extends the filing deadline to October 1, 2090, for anyone who may be diagnosed with a 9/11-related illness. The September 11th Victim Compensation Fund credits the enactment of this law to the “responders, survivors, and advocates who worked tirelessly to secure its passage, and in turn, our ability to continue our vital work.”

Who is eligible for compensation from the September 11th Victim Compensation Fund?

The list of those who are eligible for compensation through the September 11th Victim Compensation Fund is a long one. It begins, of course, with the family or personal representatives of those killed in the attacks on September 11, 2001. It does not end there. Any person – or, if they are deceased, their personal representative – who was present at the World Trade Center, the Pentagon, or the Shanksville, Pennsylvania crash site from September 11, 2001, to May 30, 2002, and suffered a 9/11-related injury or has been diagnosed with a 9/11-related illness, is eligible for compensation from the September 11th Victim Compensation Fund.” In New York City, this includes:

- First responders such as firefighters, police officers, and EMS

- Construction workers, volunteers, and anyone else who helped in the rescue, recovery, clean-up, or debris removal

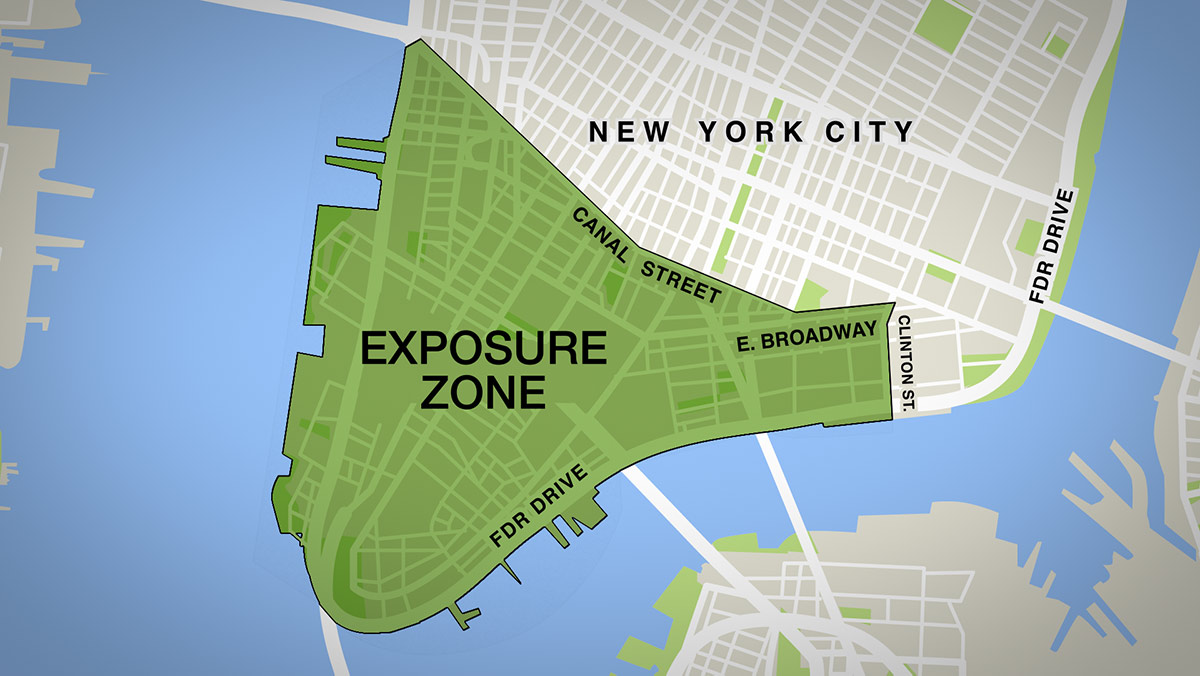

- Any person who lived, worked, or attended school in the New York City “Exposure Zone”

According to the September 11th Victim Compensation Fund, the NYC Exposure Zone encompasses all of lower Manhattan south of Canal Street, East Broadway, and Clinton Street from the Hudson River to the East River. The September 11th Victim Compensation Fund also defines the Exposure Zone in New York City as including “any area related to or along the routes of debris removal, such as barges and Fresh Kills landfill.”

Those applying to the September 11th Victim Compensation Fund or the World Trade Center Health Program must prove they were present in the 9/11 exposure zone between September 11, 2001, and May 30, 2002.

Are the World Trade Center Health Program and the September 11th Victim Compensation Fund the same program?

No. The World Trade Center Health Program (WTC Health Program) and the September 11th Victim Compensation Fund are two separate programs. Each has its own eligibility criteria, is administered by different federal agencies, and members of the WTC Health Program are not required to register or file a claim with the September 11th Victim Compensation Fund.

It should be noted, however, that per the U.S. Centers for Disease Control and Prevention (CDC), September 11th Victim Compensation Fund claimants are required to “be enrolled in and have their physical condition(s) certified for treatment by the WTC Health Program to process a VCF claim and award compensation.”

The WTC Health Program provides medical monitoring and treatment of World Trade Center-related health conditions for 9/11 responders and survivors. It is administered by the National Institute for Occupational Safety and Health and serves those who responded to the World Trade Center and related sites in New York City, as well as the Pentagon and the Shanksville, PA site. The WTC Health Program also serves survivors who were “present in the dust or dust cloud, and/or lived, worked, or went to school in the WTC Health Program’s New York City Disaster Area.” Detailed eligibility guidelines for the WTC Health Program are available here.

Does a September 11th Victim Compensation Fund award count as taxable income?

No, September 11th Victim Compensation Fund awards are not considered taxable income by the United States Internal Revenue Service (IRS). Victim or their representatives who receive monetary compensation from the September 11th Victim Compensation Fund are not required to report this financial restitution when filing their federal income taxes. U.S. tax code clearly states under Code Section 26 U.S.C. 139(f), that payments from the September 11th Victim Compensation Fund to victims suffering physical injury or death are tax-free.

In IRS Publication 3920, “Tax Relief for Victims of Terrorist Attacks,” the IRS outlined and explained some of the provisions of the Victims of Terrorism Tax Relief Act of 2001. Per that Act, the following monetary awards are not considered taxable income:

- “Certain disability payments received in tax years ending after September 10, 2001, for injuries sustained in a terrorist attack

- Payments from the September 11th Victim Compensation Fund of 2001

- Qualified disaster relief payments made after September 10, 2001, to cover personal, family, living, or funeral expenses incurred because of a terrorist attack

- Death benefits paid by an employer to the survivor of an employee if the benefits are paid because the employee died as a result of a terrorist attack”

Contact our 9/11 attorneys today

If you or a loved one have been diagnosed with a 9/11-related illness, or if a loved one has died of an illness that was caused by exposure to toxic dust from the September 11 terrorist attacks, you may be eligible for compensation through the September 11th Victim Compensation Fund. The claim process is complex and even one error may result in your claim being denied. The experienced New York 9/11 fund lawyers at Weisfuse & Weisfuse, LLP can help. As skilled personal injury lawyers in New York City, they have a record of fighting on behalf of 9/11 victims. To schedule a free consultation with one of the firm’s knowledgeable 9/11 lawyers, call us at (212) 983-3000 or contact us online today.